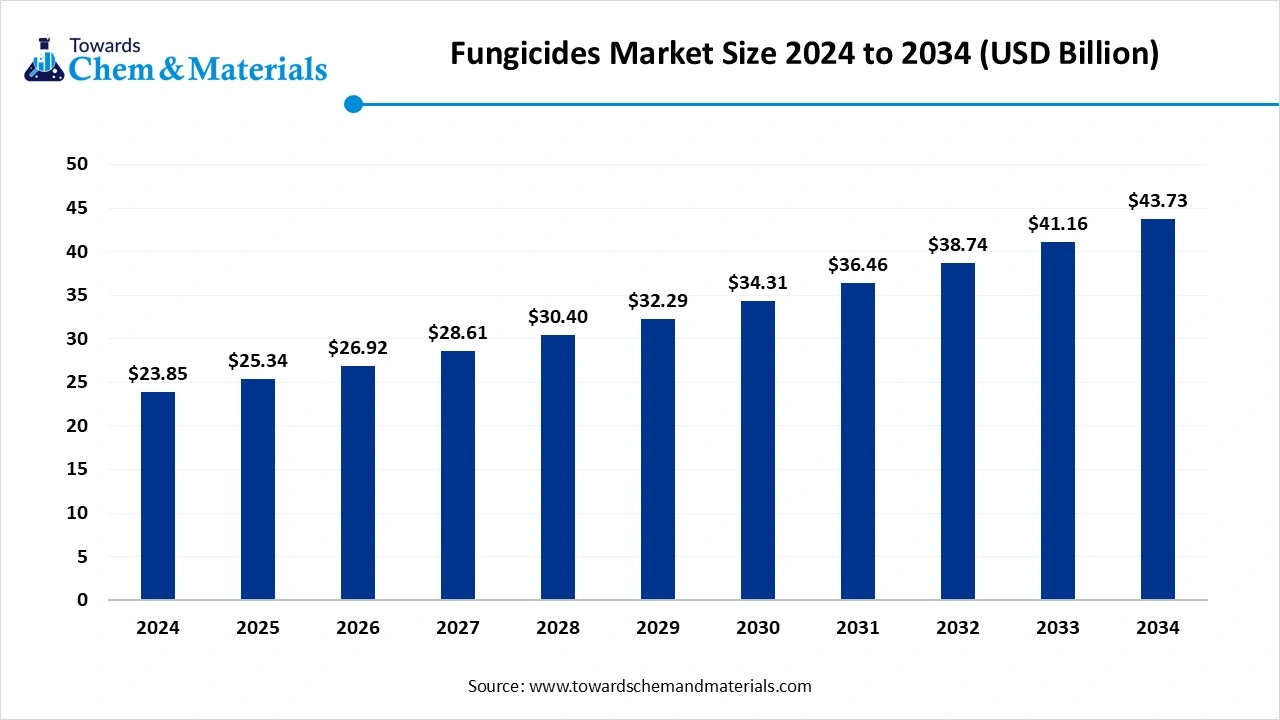

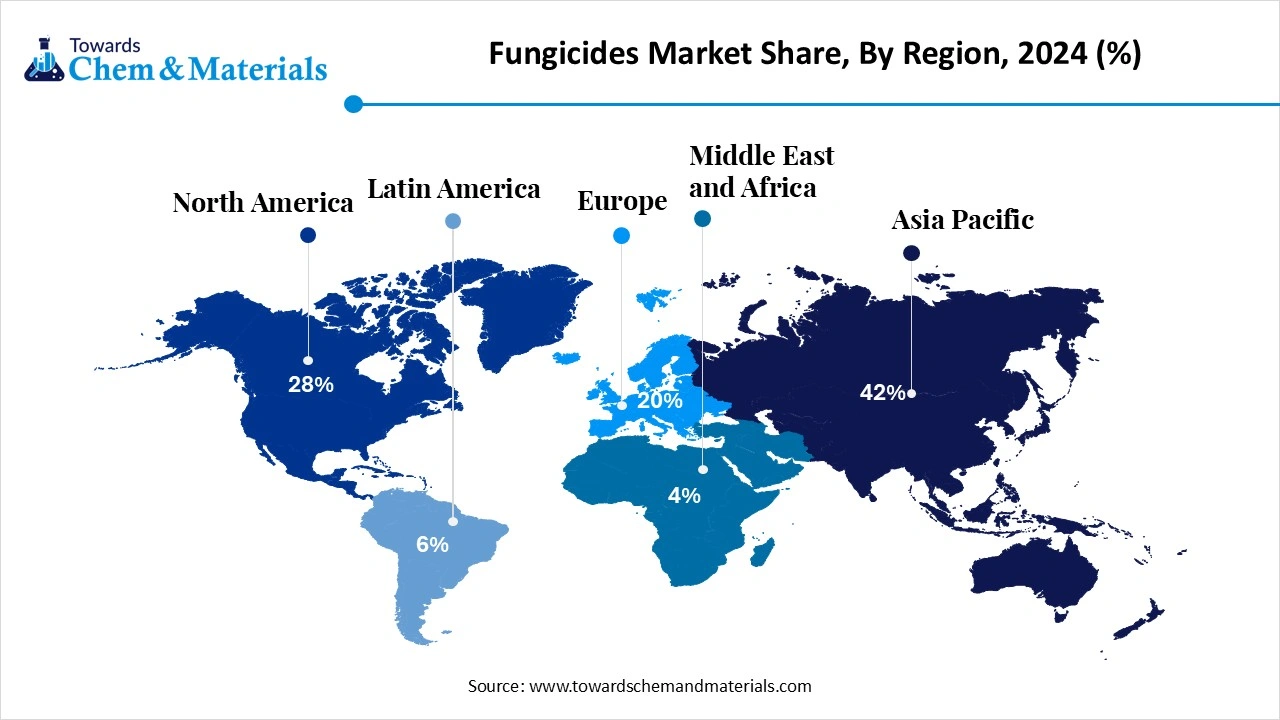

Ottawa, Nov. 25, 2025 (GLOBE NEWSWIRE) -- The global fungicides market size was valued at USD 25.34 billion in 2025. The market is projected to grow from USD 26.92 billion in 2026 to USD 43.73 billion by 2034 at a CAGR of 6.25% during the forecast period. North America dominated the Fungicides market with a market share of 42% in 2024. The growth of the fungicides market is driven by rising global food demand and the need to protect crops from diseases. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5942

What are Fungicides?

The fungicides market is a crucial segment of the global crop protection industry, focusing on preventing and controlling fungal diseases in various crops. Its growth is driven by the rising demand for food, high-value crops, and the need to improve yield and quality. Both chemical and bio-based fungicides are witnessing increased adoption due to effectiveness and environmental considerations. Technological advancements, such as systemic formulations and targeted application methods, are enhancing efficiency and safety. The market is also supported by government initiatives, research investments, and rising awareness of integrated pest management practices among farmers.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Fungicides Market Report Highlights

- The Asia Pacific fungicides market dominated the global market with the revenue share of 39.1% in 2024.

- Country-wise, the fungicides market in China dominated the Asia Pacific market in 2024.

- By chemical class, the triazoles segment accounted for the largest revenue share of 32% in 2024.

- By mode of action, the systemic segment accounted for the largest revenue share of 45% in 2024.

- By formulation type, the suspension concentrates (SC) segment accounted for the largest revenue share of 33% in 2024.

- By end use, the commercial farmers segment accounted for the largest revenue share of 70% in 2024.

- By distribution channel, the agrodealers / distributors segment accounted for the largest revenue share of 58% in 2024.

Why Do Farmers Use Fungicide?

Farmers apply fungicides to protect crops from diseases that reduce plant health, yield and quality potential. Proactively applying fungicides can keep plants strong and healthy through harvest, making the harvest process more efficient by reducing lodged crops.

Benefits of a fungicide application include:

- Increased photosynthesis: With more healthy leaf area, plants can more effectively use nutrients to achieve maximum yield.

- Greater stress tolerance: Vigorous plants are better at withstanding stressors like drought or extreme temperature variation.

- Increased water use efficiency: Healthy stalks and leaves are more efficient at using water, leading to an extended grain fill period, thus more opportunity to develop yield.

- Increased standability: With fewer stalk diseases, you’ll have fewer stalk issues and less lodging, leading to increased yield (because you're reducing ear loss at harvest).

Are Fungicide Applications Profitable?

Fungicide profitability will vary year-to-year depending on the disease pressure, cost of inputs and crop value. Generally, even in years when disease pressure is low, fungicides can provide plant health benefits that keep leaves greener longer to maximize grain and fruit production.

Fungicides can provide a positive return on investment when:

- You choose the right product. By selecting a fungicide that provides control of the most common diseases in your geography, you can increase the likelihood of effectiveness. That increases the ROI potential of your fungicide application.

- You make a timely application. When a fungal disease is present at application, a fungicide can halt the growth of the current pathogens and protect against another disease incidence. If no disease is evident at the time of application, a fungicide can also help to protect from any potential fungal infections.

Smart Sprays: How AI is Revolutionizing the Fungicides Industry

Artificial intelligence is transforming the fungicides industry by enabling precision agriculture, where AI-powered sensors and drones detect fungal infections early and guide targeted fungicide applications. Predictive analytics allow farmers to forecast disease outbreaks and optimize treatment schedules, reducing chemical usage and costs. AI-driven formulation research is accelerating the development of more effective and environmentally friendly fungicides. Overall, these innovations are improving crop yields, sustainability, and operational efficiency across the sector.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5942

Fungicides Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 26.92 billion |

| Revenue forecast in 2034 | USD 43.73 billion |

| Growth rate | CAGR of 6.25% from 2025 to 2034 |

| Base year for estimation | 2025 |

| Historical data | 2018 - 2025 |

| Forecast period | 2025 - 2034 |

| Quantitative units | Volume in Kilotons, Revenue in USD Million, and CAGR from 2025 to 2034 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Type / Chemical Class, By Mode of Action, By Formulation Type, By End Use, By Distribution Channel, By Region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Indonesia; Brazil; Argentina; South Africa; Egypt |

| Key companies profiled | Nufarm Ltd.; FMC Corporation; DuPont; BASF Agricultural Solution; Cheminova A/S; Bayer CropScience; Syngenta AG; Dow AgroSciences; Lanxess AG; Monsanto; Adama Agricultural Solutions; Simonis B.V. |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Private Industry Investments in the Fungicides Industry:

- BASF is investing a high double-digit million-euro amount to build a new fermentation plant in Ludwigshafen to produce biological fungicides and other biotech crop-protection products.

- Bayer committed around €100 million in a Series A investment with Ginkgo Bioworks to co-develop microbial solutions, including next-generation biological fungicides.

- UPL acquired OptiCHOS, a naturally derived fungicide, to expand its portfolio of biodegradable and broad-spectrum crop protection solutions.

- Bayer invested approximately €100 million to expand production capacity for its Nativo fungicide line to meet rising global demand.

- BASF invested €15 million to increase fungicide production capacity by 45% at one of its sites, strengthening supply for key agricultural markets.

What are the Key Trends of the Fungicides Market?

- Shift Towards Biological and Sustainable Solutions: Driven by growing consumer demand for organic produce and stricter environmental regulations, the market is moving toward bio-based fungicides derived from natural sources or beneficial microorganisms. These products offer environmentally friendly alternatives with lower chemical residues in food, aligning with global sustainability goals.

- Focus on Fungicide Resistance Management: The overuse of single-mode-of-action chemical fungicides has led to pathogens developing resistance, reducing product efficacy. This challenge has prompted the industry to prioritize the development of new active ingredients and the use of combination/multi-mode products and stewardship programs to ensure long-term effectiveness.

- Adoption of Precision Agriculture Technologies: Advancements in technology, such as the use of drones and sensor-based systems, are enabling more targeted and efficient fungicide applications. Precision agriculture helps optimize application timing, minimize product waste, and reduce the environmental footprint, thereby improving overall crop protection efficiency and cost-effectiveness for farmers.

Market Opportunity

The Bio-Boost: Why Biological Fungicides Are the Next Big Opportunity

A major opportunity in the fungicides market lies in the rapid expansion of biological fungicides, driven by stricter environmental regulations and growing demand for residue-free crops. These bio-based solutions offer targeted disease control with lower ecological impact, making them highly attractive for sustainable farming. Advancements in microbial technologies and fermentation methods are improving their efficacy and shelf stability, narrowing the gap with chemical alternatives. As global agriculture shifts toward eco-friendly practices, biological fungicides are positioned to become one of the fastest-growing and most profitable segments in the market.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5942

Fungicides Market Segmentation Insights

Type/Chemical Class Insights

In 2024, the triazoles segment led the market, due to their broad-spectrum activity and strong effectiveness against major fungal diseases affecting cereals, oilseeds, and fruits. Their systemic mode of action allows them to move within plant tissues, providing longer protection and reducing the frequency of applications. Triazoles are also highly valued for their resistance-management benefits, as they are often used in combination with other chemistries to maintain efficacy.

The biological & bio-based fungicides segment is growing fastest over the forecast period, due to rising global demand for sustainable, residue-free crop protection solutions. Stricter environmental regulations and consumer preference for cleaner food encouraged farmers to shift toward natural, eco-friendly fungicide options. Advances in microbial and botanical formulations significantly improved the efficacy and shelf stability of bio-fungicides, making them more competitive with chemical alternatives.

Mode of Action Insights

The systemic segment led the market in 2024 because these products move within plant tissues, offering deeper and longer-lasting protection compared to contact fungicides. Their ability to target pathogens at different growth stages makes them highly effective against a wide range of crop diseases. Farmers favored systemic options due to reduced application frequency, which lowers labor and operational costs.

The mixed-mode segment is expected to lead the market over the forecast period, because combining multiple modes of action provides stronger and more reliable control against diverse fungal pathogens. These formulations significantly reduce the risk of resistance development, making them highly preferred for long-term disease management. Farmers also value mixed-mode products for their broader spectrum and improved performance under challenging environmental conditions.

Formulation Type Insights

The suspension concentrates (SC) segment led the market in 2024 because SC formulations offer excellent stability and uniform dispersion, ensuring consistent application and high field performance. Their water-based nature reduces the use of organic solvents, making them safer for users and more environmentally friendly. Farmers favored SC products due to their ease of mixing, reduced clogging issues, and compatibility with modern spraying equipment.

The water-dispersible granules (WG) segment is growing fastest over the forecast period, because WG formulations offer superior handling safety, reducing dust exposure and improving user convenience. They dissolve quickly in water, providing uniform spray mixtures that enhance application accuracy and field performance. Farmers also prefer WG products for their long shelf life and reduced risk of storage and transportation issues compared to liquid formulations.

End-use Insights

The commercial farmers segment dominated the market because large-scale farming operations require consistent and effective disease management to protect high-value crops and maximize yields. These farmers adopt fungicides more frequently due to larger cultivated areas and greater exposure to fungal outbreaks. They also invest in advanced crop protection technologies and premium formulations to ensure higher productivity and quality.

The horticultural grower segment is projected to grow fastest over the forecast period, due to rising demand for high-value crops such as fruits, vegetables, ornamentals, and nursery plants, which require precise disease management to maintain quality and yield. Growers increasingly adopted advanced fungicide formulations to combat persistent fungal threats intensified by climate variability and greenhouse cultivation. The segment also benefited from expanding horticultural exports, where strict quality and residue standards pushed growers toward more frequent and targeted fungicide applications.

Distribution Channel Insights

In 2024, the agrodealers / distributors segment led the market because they served as the primary channel connecting manufacturers with a wide, fragmented base of farmers, ensuring broad product availability across rural and semi-urban regions. Their established distribution networks enabled the timely supply of fungicides during critical crop disease outbreaks, boosting sales. Agrodealers also offered advisory services and product recommendations, influencing farmers’ purchasing decisions and increasing the adoption of premium fungicide solutions.

The E-commerce / digital Ag platforms segment is the second-largest segment, leading the market, because farmers increasingly preferred online channels for their convenience, price transparency, and wide product assortment. These platforms offered detailed product information, user reviews, and agronomic guidance that improved purchasing confidence and encouraged adoption. Faster delivery services and attractive discounts further boosted sales, especially in regions with limited physical agrodealer access.

➤ Contact Us: sales@towardschemandmaterials.com | ☎ +1 804 441 9344

Regional Insights

Asia Pacific: The Powerhouse Driving the Future of Fungicides

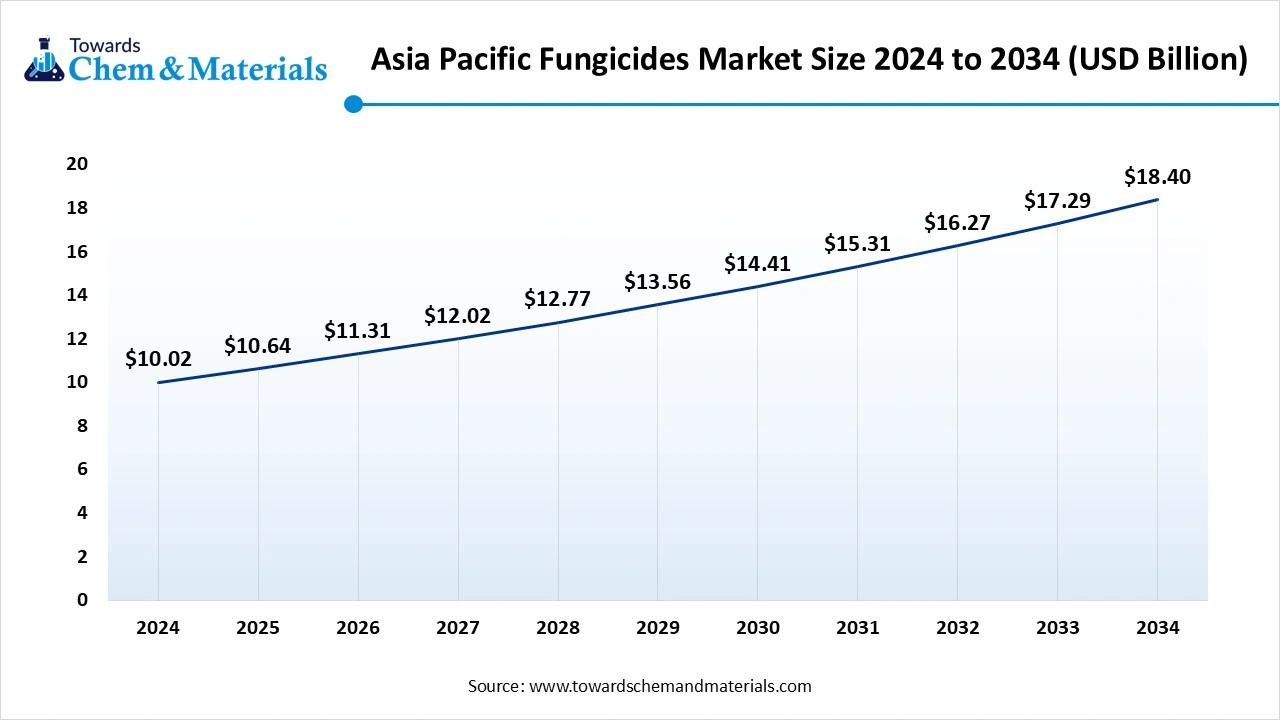

The Asia Pacific fungicides market size is valued at USD 10.64 billion in 2025 and is expected to surpass around USD 18.40 billion by 2034, expanding at a compound annual growth rate (CAGR) of 6.27% over the forecast period from 2025 to 2034.

Asia Pacific dominates the market due to its vast agricultural base and high crop disease incidence driven by humid, tropical climates. Rapid population growth and rising food demand are pushing farmers to adopt more effective crop protection solutions. Countries like China and India are investing heavily in modern farming practices, boosting fungicide usage across cereals, fruits, and vegetables. Additionally, the region’s expanding agrochemical manufacturing capacity and lower production costs strengthen its global leadership in the fungicides sector.

China Fungicides Market Trends

China is enforcing stricter maximum residue limits, pushing farmers toward premium, low-residue fungicides that meet both domestic and export standards. The market is seeing a strong shift toward biological fungicides as national policies emphasize green agriculture and sustainable crop protection. Rapid expansion of high-value protected farming, such as greenhouse and controlled-environment agriculture, is increasing demand for specialized fungicide formulations.

North America Fungicides Market Trends

The fungicides market in North America is expected to grow significantly over the forecast period, primarily due to its well-established agricultural sector with advanced farming techniques. In addition, the increasing adoption of integrated pest management (IPM) practices enhances the demand for fungicides as farmers seek sustainable solutions to combat fungal infections. Furthermore, regulatory support for innovative crop protection products further fosters market growth in this region.

U.S. Fungicides Market Trends

The U.S. fungicides market dominated North America with the largest revenue share in 2024 attributed to a strong emphasis on agricultural productivity and technological advancements. Farmers increasingly adopt precision agriculture techniques, integrating fungicide applications with data-driven decision-making to optimize crop health. In addition, the rising awareness of fungal threats to crop yields drives demand for effective fungicide solutions. Moreover, ongoing research into new formulations and active ingredients supports innovation in crop protection strategies, ensuring that U.S. agriculture remains competitive and productive.

Europe Fungicides Market Trends

The fungicides market in Europe is growing steadily due to increasing consumer demand for high-quality food products and stringent regulations promoting sustainable agriculture. Farmers are also turning to fungicides to protect their crops from various fungal diseases while adhering to environmental standards. The emphasis on integrated pest management practices encourages using fungicides as part of holistic farming strategies. Furthermore, advancements in bio fungicide development align with Europe’s shift towards more eco-friendly agricultural practices, further driving the segment growth.

The growth of the France fungicides market is largely influenced by a strong agricultural tradition focused on high-quality produce such as wine grapes and cereals. In addition, the increasing incidence of fungal diseases necessitates effective control measures, prompting farmers to invest in fungicide solutions. France's commitment to sustainable farming practices also drives demand for bio-based fungicides as alternatives to traditional chemical products. Furthermore, government initiatives to improve agricultural efficiency and productivity contribute significantly to fostering a favorable environment for fungicide usage in French agriculture.

Latin America: The Fast-Track Frontier of Fungicide Expansion

Latin America is experiencing the fastest growth in the market due to its large-scale cultivation of high-value crops like soybeans, corn, and fruits, which face significant fungal pressure. Favorable climatic conditions that promote frequent disease outbreaks are driving farmers to adopt advanced fungicide solutions. Strong agricultural export demand is pushing the region to prioritize crop quality and yield, further boosting fungicide use. Additionally, increased investment in modern farming practices and expanding agrochemical distribution networks are accelerating market growth across countries such as Brazil and Argentina.

Brazil Fungicides Market Trends

The Brazil market is expanding rapidly due to the growth of high-value crops like soybeans and corn, which face intense disease pressure and require frequent protection. Farmers are increasingly adopting multisite fungicides to manage resistance issues, particularly for controlling soybean rust, while premium systemic chemistries are gaining traction in corn production. The country is also seeing rising use of biological fungicides as sustainability and low-residue requirements become more important in both domestic and export markets.

Top Companies in the Fungicides Market & Their Offerings

- Syngenta AG (ChemChina Group): The company offers a diverse range of fungicides, including well-regarded products like Amistar Top and Ridomil Gold, which provide broad-spectrum control and are often noted for their performance and affordability.

- Corteva Agriscience: Corteva's fungicide portfolio includes products like Zorvec Enicade, Kocide, and Talendo, which are designed for crop protection against diseases like downy mildew and other fungal pathogens.

- FMC Corporation: FMC provides a variety of fungicides, such as Centaurus, Cilpyrox, and Azaka Duo, which offer solutions for controlling diseases like sheath blight in rice and other fungal pathogens with both systemic and broad-spectrum action.

- UPL Limited: UPL offers both systemic and contact fungicides, with its well-known product Saaf combining Carbendazim and Mancozeb to provide broad-spectrum control for a variety of crops.

- Nufarm Limited: Nufarm provides a portfolio of fungicides, including products with active ingredients like propineb, mancozeb, and azoxystrobin, for preventive and protective action against a wide range of fungal diseases.

- Sumitomo Chemical Co., Ltd.: Sumitomo Chemical offers fungicides with various active ingredients like tolclofos-methyl and bromuconazole for controlling diseases such as rhizoctonia, powdery mildew, and fusarium in a variety of crops.

- Adama Agricultural Solutions Ltd.: Adama's product line includes fungicides like Custodia and Shamir, which utilize dual-action formulas with ingredients such as azoxystrobin and tebuconazole to provide effective control of multiple fungal diseases.

More Insights in Towards Chemical and Materials:

- Fertilizers Market : The global fertilizers market stands at 199.29 million tons in 2025 and is forecast to reach 271.75 million tons by 2035, growing at a CAGR of 3.15% from 2025 to 2035.

- Phosphate Fertilizers Market : The global phosphate fertilizers market size is calculated at USD 70.11 billion in 2024, grew to USD 74.28 billion in 2025, and is projected to reach around USD 124.97 billion by 2034. The market is expanding at a CAGR of 5.95% between 2025 and 2034.

- Fertilizers Market : The global fertilizers market size is calculated at USD 245.97 billion in 2025 and is expected to hit around USD 380.16 billion by 2035 from USD 256.91 billion in 2026, growing at a CAGR of 4.45% from 2025 to 2035.

- Biochemical Market : The global biochemical market size was valued at USD 80.35 billion in 2024 and is predicted to increase from USD 88.89 billion in 2025 to approximately USD 220.66 billion by 2034, expanding at a CAGR of 10.63% from 2025 to 2034.

- Biofertilizer Market : The global biofertilizer market size is calculated at USD 3.31 billion in 2025 and is predicted to increase from USD 3.73 billion in 2026 and is projected to reach around USD 11.08 billion by 2035, The market is expanding at a CAGR of 12.85% between 2025 and 2035.

- Europe Fertilizers Market : The Europe fertilizers market size accounted for USD 57.67 billion in 2025 and is predicted to increase from USD 60.65 billion in 2026 to approximately USD 95.30 billion by 2035, growing at a CAGR of 5.15% from 2025 to 2035.

- U.S. Fertilizers Market : The U.S. fertilizers market size is calculated at USD 30.56 billion in 2025 and is projected to reach USD 32.08 billion in 2026, further anticipated to reach around USD 47.28 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.97% over the forecast period from 2025 to 2034.

- Controlled Release Fertilizers Market : The global controlled release fertilizers market size was reached at USD 2.50 billion in 2024 and is expected to be worth around USD 4.49 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.02% over the forecast period 2025 to 2034.

- Asia Pacific Fertilizers Market : The Asia Pacific fertilizers market size was valued at USD 168.71 billion in 2024, grew to USD 179.49 billion in 2025, and is expected to hit around USD 313.44 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.39% over the forecast period from 2025 to 2034.

- U.S. Nitrogenous Fertilizers Market : The U.S. nitrogenous fertilizer market size is valued at USD 20.42 billion in 2025 and is expected to be worth around USD 26.29 billion by 2034, growing at a compound annual growth rate (CAGR) of 2.85% over the forecast period from 2025 to 2034.

- Specialty Fertilizers Market : The global specialty fertilizers market volume was reached at 30.23 million tons in 2024 and is expected to be worth around 49.33 million tons by 2034, exhibiting at a compound annual growth rate (CAGR) of 5.02% over the forecast period 2025 to 2034.

Fungicides Market Top Key Companies:

- Nufarm Ltd.

- FMC Corporation

- DuPont

- BASF Agricultural Solutions

- Cheminova A/S

- Bayer CropScience

- Syngenta AG

- Dow AgroSciences

- Lanxess AG

- Monsanto

- Adama Agricultural Solutions

- Simonis B.V.

Recent Developments

- In September 2025, Zorvec Entecta, a fungicide for grapes and potatoes in India, was launched by Corteva Agriscience. This fungicide is based on Zorvec technology, designed to offer protection against Downy Mildew in grapes and Late Blight in potatoes.

- In June 2024, BASF Agricultural Solutions announced the launch of Cevya, a new rice fungicide in China. This is the first isopropanol triazole fungicide approved for rice applications in two decades, designed to combat rice false smut and manage fungicide resistance. Cevya's active ingredient, mefentrifluconazole, offers rice growers an innovative solution to enhance crop yields. BASF has conducted extensive field trials since 2020, collaborating with leading agricultural institutions to ensure its effectiveness and safety in disease management.

Fungicides Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Fungicides Market

By Type / Chemical Class

- Triaz

- oles (DMI fungicides)

- Strobilurins (QoI fungicides)

- Dithiocarbamates (mancozeb, thiram)

- Benzimidazoles (carbendazim, benomyl)

- Chloronitriles (chlorothalonil)

- Carbamates & Phenylamides

- Biological & Bio-based Fungicides (microbial & botanical)

By Mode of Action

- Contact (protectant)

- Systemic (curative & protective)

- Translaminar (localized systemic)

- Mixed-Mode (multi-site & combination products)

By Formulation Type

- Wettable Powders (WP)

- Suspension Concentrates (SC)

- Emulsifiable Concentrates (EC)

- Water-Dispersible Granules (WG)

- Flowables / Liquid Concentrates

By End Use

- Commercial Farmers (row crops, plantations)

- Horticultural Growers (fruits, vegetables, ornamentals)

- Seed Treatment Companies / Agrochemical Formulators

- Public Sector & Research Institutes

By Distribution Channel

- Agrodealers / Distributors

- Direct-to-Farm (contract / cooperatives)

- E-commerce / Digital Ag Platforms

- Retail / Input Stores

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5942

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/