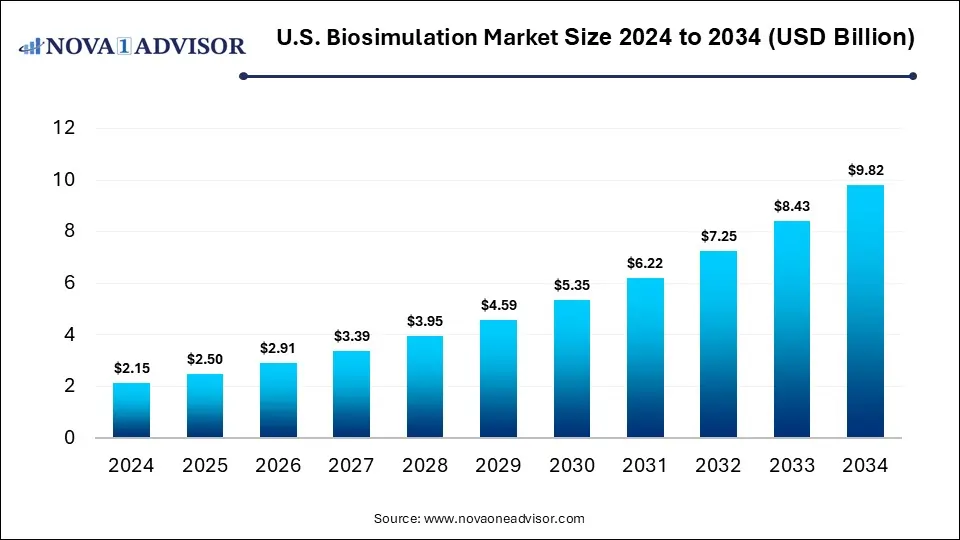

Ottawa, Nov. 21, 2025 (GLOBE NEWSWIRE) -- The U.S. biosimulation market size is calculated at USD 2.15 billion in 2024, grew to USD 2.50 billion in 2025, and is projected to reach around USD 9.82 billion by 2034. The market is projected to expand at a CAGR of 16.4% between 2025 and 2034.

Key Takeaways

- By offering, the software segment dominated the market in 2024.

- By offering, the services segment is expected to expand at the highest CAGR in the coming years.

- By application, the drug discovery & development segment led the market in 2024.

- By application, the disease modeling segment is expected to grow at the fastest rate during the projection period.

- By therapeutic area, the oncology segment dominated the market in 2024.

- By therapeutic area, the infectious diseases segment is likely to expand at a significant rate in the upcoming period.

- By deployment model, the cloud-based segment held the largest share of the market in 2024.

- By deployment model, the hybrid model segment is expected to grow at a rapid pace between 2025 and 2034.

- By pricing model, the license-based model segment led the market in 2024.

- By pricing model, the subscription-based model segment is expected to register the highest CAGR throughout the forecast period.

- By end use, the life science companies segment contributed the largest market share in 2024.

- By end use, the academic & research institutes segment is expected to expand at the fastest CAGR over the forecast period.

Download a Sample Report Here@ https://www.novaoneadvisor.com/report/sample/9217

What is U.S. Biosimulation?

Biosimulation technology is the use of computer-driven process modeling to simulate and analyze biological systems in the United States, particularly in the pharmaceutical and biotech industries. It is applied to predict how a biological system, such as the human body, will behave in response to different factors, like a drug, to enhance drug development, lower expenses, and make treatments safer and more efficient.

It is a computer-based mathematical modeling to study how the human body works and how drugs support or harm patients. It is similar to creating a computer-generated model of the human body, which is used to understand how diseases progress and how various drugs might disturb the body. By simulating real-life processes in the body, biosimulation helps scientists test different scenarios and observe how the body reacts in different health conditions. This assists scientists in developing novel drugs and treatments that are harmless and more efficient.

What are the Key Drivers in the U.S. Biosimulation Market?

Increasing demand for affordable, rapid drug development, biosimulation reduces the need for costly physical prototypes and lab work by enabling virtual testing and analysis, thereby reducing development expenses and speeding up time to market. Also, advancements in technology, such as integrating AI into biosimulation platforms, improving prediction precision, and supporting the processing of complex datasets. This technology creates targeted models of specific patients to simulate disease evolution and predict treatment results with increasing accuracy, which contributes to the growth of the market.

Immediate Delivery Available | Buy This Premium Research (Global Deep Dive USD 3800) https://www.novaoneadvisor.com/report/checkout/9217

U.S. Biosimulation Market Report Scope

| Report Attribute | Details |

| Revenue Forecast in 2025 | USD 2.50 billion |

| Revenue Forecast in 2034 | USD 9.82 billion |

| Growth rate | CAGR of 16.4% from 2025 to 2034 |

| Actual data | 2018 - 2024 |

| Forecast data | 2025 - 2034 |

| Quantitative units | Revenue in USD million/billion, and CAGR from 2025 to 2034 |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | Offering, Application, Therapeutic Area, Deployment Model, Pricing Model, End-use |

| Key companies profiled | Certara, USA.; Dassault Systèmes; Advanced Chemistry Development; Simulation Plus; Schrodinger Inc.; Chemical Computing Group ULC; Physiomics Plc; Rosa & Co. LLC; BioSimulation Consulting Inc.; Genedata AG; Instem Group of Companies; PPD, Inc.; Yokogawa Insilico Biotechnology GmbH |

| Customization scope | Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country & segment scope. |

For more information, visit the Nova One Advisor website or email the team at sales@novaoneadvisor.com | Call us : +1 804 420 9370

What are the Ongoing Trends in the U.S. Biosimulation Market?

- In September 2025, Certara Inc. took center stage at the Baird Global Medical Care Conference 2025. The company showcased its leadership in biosimulation software and services, while addressing challenges like high drug failure rates in clinical trials. Certara’s strategic direction includes leveraging AI and expanding its Total Addressable Market (TAM) amid evolving FDA regulations.

What is the Emerging Challenge in the U.S. Biosimulation Market?

Major challenges of market growth are high initial costs, the cost related to purchasing costly software licenses, the essential high-performance computing infrastructure, and the dedicated training for personnel present a significant barrier to entry, particularly for smaller biotech organizations and academic institutions.

Segmental Insights

By Offering Analysis

Why Did the Software Segment Dominate the U.S. Biosimulation Market in 2024?

The software segment dominated the market with the largest share in 2024 due to biosimulation software is being used in pharmacological drug development to mimic diseases. Virtual clinical trials of novel advancement therapeutic drugs are conducted on computers running disease simulations. It offers a platform for reusing and sharing biomodels, simulations, simulation outcomes, and visualizations of simulation results.

The services segment is expected to expand at the highest CAGR throughout the projection period due to this service quickly increasing scientists’ understanding of how a drug works, how much drug various people need and when, and how to better cure or prevent diseases with it. The services assistances in developing tailored treatment plans by simulating how a specific patient might respond to a particular therapy based on their exclusive physiological and genetic data.

U.S. Biosimulation Market Size 2024 to 2034 (USD Billion)

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Software | 1.29 | 1.51 | 1.76 | 2.06 | 2.42 | 2.82 | 3.31 | 3.86 | 4.52 | 5.29 | 6.19 |

| Services | 0.86 | 0.99 | 1.15 | 1.33 | 1.53 | 1.77 | 2.04 | 2.36 | 2.73 | 3.14 | 3.63 |

By Application Analysis

How Does the Drug Discovery & Development Segment Lead the Market in 2024?

The drug discovery and development segment led the U.S. biosimulation market while holding the largest share in 2024 due to its support analysis and predicting system behavior, which is appreciated in understanding the healthcare results of drug discovery or advancement before any human trials. Biosimulation enhances cost efficiencies in the drug discovery and development process by identifying value drivers such as translatability, efficacy, toxicity, adverse reactions, and DDI at earlier stages of product advancement.

The disease modeling segment is expected to expand at a rapid pace throughout the forecast period as biosimulation predominantly cuts the time needed to bring novel medicines by allowing scientists to optimize and identify potential drug candidates and targets more effectively than traditional approaches. The incorporation of progressive technologies such as artificial intelligence (AI) and machine learning (ML) with biosimulation platforms enhances the accuracy of models.

U.S. Biosimulation Market Size 2024 to 2034 (USD Billion)

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Drug Discovery & Development | 1.25 | 1.43 | 1.65 | 1.9 | 2.2 | 2.53 | 2.91 | 3.35 | 3.86 | 4.44 | 5.11 |

| Disease Modeling | 0.6 | 0.7 | 0.81 | 0.94 | 1.09 | 1.26 | 1.47 | 1.7 | 1.97 | 2.28 | 2.65 |

| Other (Precision Medicine, Toxicology) | 0.3 | 0.37 | 0.45 | 0.55 | 0.66 | 0.8 | 0.97 | 1.17 | 1.42 | 1.71 | 2.06 |

By Therapeutic Area Analysis

What Made Oncology the Dominant Segment in the U.S. Biosimulation Market?

The oncology segment led the U.S. biosimulation market in 2024 due biosimulation enables investigators to digitally test potential cancer medicine and detect their effects before extensive physical testing. This supports identifying promising drug candidates faster, lowering the overall time it takes to bring novel therapies to market.

The infectious diseases segment is expected to grow at the fastest rate over the forecast period. Biosimulation models integrate data on pathogen behaviour, host immune responses, and treatment to detect how infectious diseases progress and assess the impact of potential drug-fighting mechanisms.

U.S. Biosimulation Market Size 2024 to 2034 (USD Billion)

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Oncology | 0.82 | 0.96 | 1.12 | 1.31 | 1.53 | 1.79 | 2.1 | 2.45 | 2.87 | 3.35 | 3.93 |

| Cardiovascular Disease | 0.39 | 0.45 | 0.52 | 0.6 | 0.7 | 0.8 | 0.93 | 1.08 | 1.25 | 1.44 | 1.67 |

| Infectious Disease | 0.34 | 0.39 | 0.45 | 0.52 | 0.6 | 0.69 | 0.79 | 0.91 | 1.04 | 1.2 | 1.37 |

| Neurological Disorders | 0.32 | 0.38 | 0.45 | 0.53 | 0.62 | 0.74 | 0.87 | 1.02 | 1.2 | 1.42 | 1.67 |

| Others | 0.28 | 0.32 | 0.37 | 0.43 | 0.5 | 0.57 | 0.66 | 0.76 | 0.89 | 1.02 | 1.18 |

By Deployment Model Analysis

How Does the Cloud-Based Segment Lead the Market in 2024?

The cloud-based segment held the biggest share of the U.S. biosimulation market in 2024, as cloud offers more reliability and flexibility, enhanced performance and effectiveness, and support to lower IT expenses. It improves novelty, enabling organizations to attain faster time and integration of AI and machine learning use cases in their approaches.

The hybrid model segment is expected to expand at a rapid pace throughout the forecast period as this type of modeling is an evolving modeling paradigm that explores the synergy among existing these two paradigms, taking advantage of the present process knowledge and data disseminated by the gathered information. Hybrid clouds provide powerful and flexible services by integrating the strengths of both private and public cloud infrastructures.

U.S. Biosimulation Market Size 2024 to 2034 (USD Billion)

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Cloud-based | 0.95 | 1.13 | 1.35 | 1.61 | 1.93 | 2.3 | 2.74 | 3.26 | 3.88 | 4.62 | 5.5 |

| On-premise | 0.73 | 0.82 | 0.92 | 1.03 | 1.15 | 1.28 | 1.43 | 1.59 | 1.77 | 1.96 | 2.16 |

| Hybrid Model | 0.47 | 0.55 | 0.64 | 0.75 | 0.87 | 1.01 | 1.18 | 1.37 | 1.6 | 1.85 | 2.16 |

By Pricing Model Analysis

Why Did the License-Based Segment Lead the U.S. Biosimulation Market in 2024?

The license-based model segment dominated the market with a major share in 2024, as the license model offers consumer access to advanced biosimulation software and high-performance computing (HPC) resources without the need for substantial internal spending in infrastructure maintenance or development.

The subscription-based model segment is expected to register the highest CAGR throughout the projection period due to subscriptions confirming workers always have access to the modern software forms, features, updates, and technological development without the requirement to manage manual advancements. The model enables providers to simply scale up or down their applications based on project requirements and demand, without worrying about extra paperwork or extensive processes.

U.S. Biosimulation Market Size 2024 to 2034 (USD Billion)

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| License-based Model | 0.75 | 0.84 | 0.94 | 1.05 | 1.18 | 1.31 | 1.45 | 1.61 | 1.78 | 1.96 | 2.16 |

| Subscription-based Model | 0.6 | 0.72 | 0.86 | 1.03 | 1.23 | 1.47 | 1.75 | 2.09 | 2.49 | 2.97 | 3.53 |

| Service-based Model | 0.54 | 0.62 | 0.72 | 0.84 | 0.97 | 1.12 | 1.32 | 1.51 | 1.76 | 2.03 | 2.36 |

| Pay Per Use Model | 0.26 | 0.32 | 0.39 | 0.47 | 0.57 | 0.69 | 0.83 | 1.01 | 1.22 | 1.47 | 1.77 |

By End Use Analysis

How do Life Science Companies Hold the Largest Share of the Market in 2024?

The life science companies segment held the largest share of the U.S. biosimulation market in 2024, as biosimulation is a relatively advanced instrument in the healthcare drug development and medical care that promises marvelous advantages, saving both time and money and refining the predictability in the initial stage of drug development.

The academic and research institutes segment is expected to expand at the fastest CAGR in the upcoming period due to biosimulation enables scientists to create predictive models of biological systems, allowing them to assess the effects of various drugs and dosages on the body, earlier than conducting costly and time-consuming healthcare trials. This lowers the number of clinical studies needed, saving resources and time.

By Regional Insight

How did the U.S. Grow Notably in the Market in 2024?

In the U.S. biosimulation market is dominated by strong government support from the FDA, significant development in artificial intelligence (AI), and the growing demand for affordable drug development services. The incorporation of advanced technology, such as AI and machine learning (ML), in the biosimulation platforms has dramatically improved their predictive accuracy and efficiency. The growing shift towards cloud-driven and hybrid deployment models for biosimulation software offered superior scalability, remote convenience, and lower upfront infrastructure expenses, quickening massive adoption, which drives the growth of the market.

U.S. Biosimulation Market Value Chain Analysis

1. Research & Development (R&D) and Data Generation

This stage involves gathering biological, pharmacological, and clinical data necessary for creating biosimulation models. Pharmaceutical companies, academic institutions, and CROs (Contract Research Organizations) generate large datasets through lab research, preclinical studies, and early-phase trials, which serve as the foundation for simulation models. The quality and depth of this data are critical, as they directly impact the accuracy of predictive modeling.

2. Software Development & Tool Design

Specialized biosimulation software is developed to analyze and model complex biological systems. This includes platforms for molecular modeling, PBPK/PKPD simulation, toxicity prediction, and trial simulation. Developers integrate advanced technologies like AI and machine learning to enhance functionality, speed, and usability, ensuring that tools are capable of handling large, complex datasets for varied therapeutic applications.

3. Service Provision (Consulting, Implementation & Support)

At this stage, biosimulation companies and service providers offer contract research, consulting, training, and support services to help clients integrate simulation tools into their drug development workflows. These services are essential for companies that lack in-house expertise or infrastructure, enabling broader market adoption and efficient use of biosimulation technologies.

4. End Use Application (Drug Discovery, Clinical Trials, Regulatory Submissions)

Biosimulation tools are applied in real-world scenarios such as drug discovery, lead optimization, dosing strategy design, and clinical trial simulation. They also play a growing role in regulatory submissions, with agencies like the FDA supporting model-informed drug development (MIDD). This application stage directly contributes to reducing R&D costs, minimizing trial failures, and accelerating product approvals.

5. Regulatory & Market Access

Regulatory review and acceptance of biosimulation data is a critical final step in the value chain. Agencies evaluate simulation outcomes to support drug approval decisions, particularly in areas like dose justification, safety prediction, and trial design.

Key Players Operating in the Market

1. Certara

Certara is a leading provider of biosimulation software and services, widely recognized for its PBPK modeling and Model-Informed Drug Development (MIDD) solutions. Its platforms like Phoenix and Simcyp are extensively used in regulatory submissions and clinical trial optimization across the U.S. pharmaceutical industry.

2. Dassault Systèmes

Through its BIOVIA brand, Dassault Systèmes delivers advanced biosimulation, molecular modeling, and informatics tools tailored for life sciences research. The company’s solutions support collaborative R&D, enabling pharmaceutical companies to accelerate drug discovery and streamline regulatory workflows.

3. Advanced Chemistry Development (ACD/Labs)

ACD/Labs provides specialized software for molecular characterization, cheminformatics, and physicochemical property prediction. Its tools aid biosimulation workflows by improving data quality and enabling accurate modeling of drug behavior in silico.

4. Simulations Plus

Simulations Plus offers powerful simulation tools for ADMET prediction, pharmacokinetics (PK), and pharmacodynamics (PD) modeling. Its widely used platforms like GastroPlus and DDDPlus support early-stage drug screening and clinical trial design across U.S. research institutions and biopharma companies.

5. Schrödinger, Inc.

Schrödinger specializes in molecular-level simulation software used in computational drug design and discovery. Its physics-based modeling tools and collaborative platforms like LiveDesign enhance the speed and precision of small molecule research in the U.S. biosimulation market.

6. Chemical Computing Group ULC

This company develops the Molecular Operating Environment (MOE), a versatile platform for molecular modeling, bioinformatics, and cheminformatics. MOE is used by U.S. researchers to conduct protein-ligand simulations, QSAR studies, and drug design workflows.

7. Physiomics Plc

Physiomics offers oncology-focused biosimulation services, including Virtual Tumor technology, which helps optimize cancer treatment strategies. The company supports U.S. biopharma firms by providing predictive modeling solutions for dosing regimens and clinical trial planning.

8. Rosa & Co. LLC

The company is known for its PhysioPD™ platform, which builds quantitative systems pharmacology (QSP) models to simulate disease progression and treatment effects. It works closely with U.S. pharmaceutical companies to reduce R&D risks and guide clinical development decisions.

9. BioSimulation Consulting Inc.

BioSimulation Consulting Inc. provides specialized modeling and simulation services, including PK/PD analysis, trial simulation, and model validation. Its tailored consulting helps U.S. clients integrate biosimulation into regulatory and research strategies effectively.

10. Genedata AG

Genedata offers a range of software platforms that support high-throughput data analysis and modeling for biosimulation. Its tools are used by U.S. biopharma companies to manage complex datasets and optimize experimental design in early drug discovery.

11. Instem Group of Companies

Instem delivers software solutions for preclinical and clinical data analysis, including modeling and simulation tools. The company helps U.S. organizations align biosimulation with regulatory requirements, particularly in toxicology and safety assessment.

12. PPD, Inc.

PPD, a global contract research organization, integrates biosimulation into its clinical trial services to enhance protocol design and dose optimization. Its modeling capabilities support more efficient drug development for U.S. pharmaceutical clients.

13. Yokogawa Insilico Biotechnology GmbH

A subsidiary of Yokogawa, Insilico Biotechnology provides cell-based modeling and simulation solutions for bioprocess optimization and systems biology. Its U.S. presence supports pharma and biotech firms in improving biologics manufacturing and cell therapy development.

14. In Silico Biosciences, Inc.

Focused on PBPK and systems pharmacology modeling, In Silico Biosciences brings specialized simulation tools that streamline drug development workflows. Its niche expertise supports highly targeted applications in pharmacokinetic prediction and translational modelling.

What are the Recent Developments in the U.S. Biosimulation Market?

- In October 2025, Global pharma major Lupin announced the launch of a strategic partnership program to expand the reach of its long-acting injectable (LAI) platform, PrecisionSphere, developed by its subsidiary Nanomi B.V.

- In June 2024, Simulations Plus, Inc. announced the acquisition of Pro-ficiency Holdings, Inc. and its subsidiaries, a leader in providing simulation-enabled performance and intelligence solutions for clinical and commercial drug development.

More Insights in Nova One Advisor:

- Biosimulation Market - The Biosimulation market size was exhibited at USD 3.27 billion in 2022 and is projected to hit around USD 15.6 billion by 2032, growing at a CAGR of 16.9% during the forecast period 2023 to 2032.

- Gene Editing Market - The global gene editing market size is calculated at USD 9.75 billion in 2024, grows to USD 11.29 billion in 2025, and is projected to reach around USD 42.13 billion by 2034, expanding at a CAGR of 15.76% from 2025 to 2034.

- Pharmacy Benefit Management Market - The global pharmacy benefit management market size was estimated at USD 747.45 billion in 2024 and is expected to hit USD 1,787.42 billion in 2034, expanding at a CAGR of 9.11% during the forecast period of 2025 and 2034.

- Non-specific Endonucleases Market - The global non-specific endonucleases market size was estimated at USD 362.55 million in 2024 and is expected to hit USD 667.26 million in 2034, expanding at a CAGR of 6.29% during the forecast period of 2025 and 2034.

- NUT Midline Carcinoma Treatment Market - The global NUT Midline Carcinoma Treatment market size is calculated at USD 21.75 billion in 2024, grows to USD 24.97 billion in 2025, and is projected to reach around USD 86.47 billion by 2034, growing at a CAGR of 14.8% from 2025 to 2034.

- Healthcare Contract Research Organization Market - The global healthcare contract research organization market size is calculated at USD 56.15 billion in 2024, grows to USD 60.33 billion in 2025, and is projected to reach around USD 115.08 billion by 2034, growing at a CAGR of 7.44% from 2025 to 2034.

- Contract Research Organization Services Market - The global contract research organization services market size is calculated at USD 71.55 billion in 2024, grows to USD 77.01 billion in 2025, and is projected to reach around USD 149.26 billion by 2034, growing at a CAGR of 7.62% from 2025 to 2034.

- Peripheral Nerve Stimulators Market - The global peripheral nerve stimulators market size was estimated at USD 1.25 billion in 2025 and is expected to reach USD 2.18 billion in 2035, expanding at a CAGR of 5.7% during the forecast period of 2026 and 2035.

- Glucose Injection Market - The global glucose injection market size was estimated at USD 2.55 billion in 2024 and is expected to reach USD 5.21 billion in 2034, expanding at a CAGR of 7.4% during the forecast period of 2025 and 2034.

- Foot And Ankle Trauma Market - The global foot and ankle trauma market size is calculated at USD 2.15 billion in 2024, grows to USD 2.29 billion in 2025, and is projected to reach around USD 4.12 billion by 2034, growing at a CAGR of 6.73% from 2025 to 2034.

- Healthcare Command Centers Market - The global healthcare command centers market size was estimated at USD 2.15 billion in 2024 and is expected to reach USD 6.05 billion in 2034, expanding at a CAGR of 10.9% during the forecast period of 2025 and 2034.

- Genomics Data Analysis Market - The global genomics data analysis market size is calculated at USD 6.85 billion in 2024, grows to USD 7.91 billion in 2025, and is projected to reach around USD 28.74 billion by 2034, growing at a CAGR of 15.42% from 2025 to 2034.

- Patient Lift Pendant Market - The global patient lift pendant market size was estimated at USD 536.25 million in 2024 and is expected to reach USD 1,411.26 million in 2034, expanding at a CAGR of 10.16% during the forecast period of 2025 and 2034.

- Artificial Intelligence for Healthcare Payer Market - The global artificial intelligence for healthcare payer market size was estimated at USD 2.55 billion in 2024 and is expected to reach USD 10.57 billion in 2034, expanding at a CAGR of 15.28% during the forecast period of 2025 and 2034.

- Pharmaceutical Glycerine Market - The global pharmaceutical glycerine market size is calculated at USD 1.75 billion in 2024, grows to USD 1.91 billion in 2025, and is projected to reach around USD 4.30 billion by 2034, growing at a CAGR of 9.4% from 2025 to 2034.

- Recombinant Peptide Market - The global recombinant peptide market size was estimated at USD 6.02 billion in 2024 and is expected to reach USD 16.18 billion in 2034, expanding at a CAGR of 10.4% during the forecast period of 2025 and 2034.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. biosimulation market.

By Offering

- Software

- Molecular Modeling & Simulation Software

- Clinical Trial Design Software

- PK/PD Modeling and Simulation Software

- Pbpk Modeling and Simulation Software

- Toxicity Prediction Software

- Other Software

- Services

- Contract Services

- Consulting

- Other (Implementation, Training, & Support)

By Application

- Drug Discovery & Development

- Disease Modeling

- Other (Precision Medicine, Toxicology)

By Therapeutic Area

- Oncology

- Cardiovascular Disease

- Infectious Disease

- Neurological Disorders

- Others

By Deployment

- Cloud-based

- On-premise

- Hybrid Model

By Pricing Model

- License-based Model

- Subscription-based Model

- Service-based Model

- Pay Per Use Model

By End-use

- Life Sciences Companies

- Academic Research Institutions

- Others (CROs/CDMOs, Regulatory Authorities)

Immediate Delivery Available | Buy This Premium Research Report (Global Deep Dive USD 3800) https://www.novaoneadvisor.com/report/checkout/9217

About-Us

Nova One Advisor is a global leader in market intelligence and strategic consulting, committed to delivering deep, data-driven insights that power innovation and transformation across industries. With a sharp focus on the evolving landscape of life sciences, we specialize in navigating the complexities of cell and gene therapy, drug development, and the oncology market, enabling our clients to lead in some of the most revolutionary and high-impact areas of healthcare.

Our expertise spans the entire biotech and pharmaceutical value chain, empowering startups, global enterprises, investors, and research institutions that are pioneering the next generation of therapies in regenerative medicine, oncology, and precision medicine.

Our Trusted Data Partners

Towards Chemical and Materials | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | Towards Chem and Material

Web: https://www.novaoneadvisor.com/

Contact Us

USA: +1 804 420 9370

Email: sales@novaoneadvisor.com

For Latest Update Follow Us: LinkedIn